It is a business structure owned by an individual who has full control and authority of its own assets and personally owes and answers all liabilities or suffers all losses but also enjoys all the profits to the exclusion of others.

A Sole Proprietorship must apply for a Business Name and be registered with the Department of Trade and Industry (DTI).

Most of the small businesses in the Philippines are registered as sole proprietorship as it has its advantages such as:

- No minimum amount of capital required.

- The Sole Proprietor or owner has complete control over the business.

- All assets and profits are acquired by the proprietor

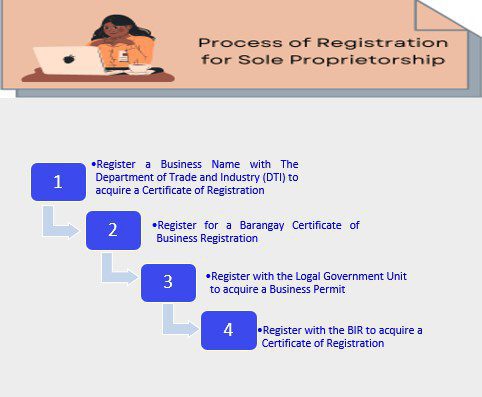

How to Set Up a Sole Proprietorship

Registering a Sole Proprietorship requires that the individual registering is a Filipino citizen.

- Register a Business Name with DTI

Open the DTI’s website then sign up to register. Search whether the business name you have decided is similar to an already existing industry. Once the preferred business name is approved, fill out the other necessary information on the application form then pay the registration fee.

- Register with the Barangay

Once the DTI issues the Certificate of Registration, proceed to obtain a Barangay Clearance from the Barangay where the address is located. Pay the assessed amount attaching a copy of the Certificate of Registration, proof of residence and other pertinent requirements. The fees vary depending on the local government unit.

- Register with the Local Government Unit

Proceed to the Business Permits and Licensing Division of the Municipality or City where the business is registered once the Barangay Clearance has already been acquired. Proceed for assessment then then submit all the other documents acquired together with the application form. Pay the assessed registration fee

- Register with the BIR

With the DTI’s Certificate of Registration, one can now proceed to the BIR to pay the required registration fee plus the document stamp tax.