Corporations are juridical persons established under the Revised Corporation Code of the Philippines (RA 11232) and regulated by the Securities and Exchange Commission (SEC). It is separate and distinct from its shareholders thus the liability of the shareholders of a corporation is limited to the amount of their share capital.

A corporation may be formed by at least one incorporator shareholder thus forming a One Person Corporation (OPC), or can have at least two (2) to fifteen (15) incorporators each of whom holding at least one share registered with the SEC.

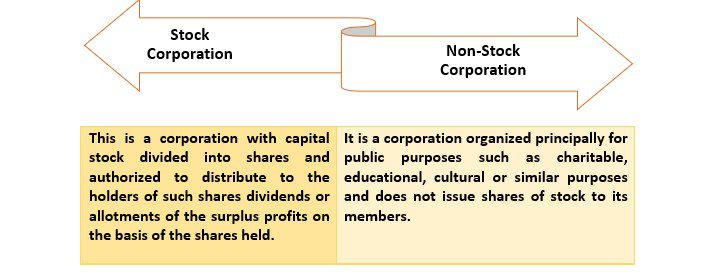

It may also either be a foreign or domestic corporation depending on the nationality of its majority shareholders. If 60% Filipino – 40% foreign-owned, it is considered a Filipino corporation. If more than 40% foreign-owned, it is considered a foreign- owned corporation. It can either be stock or non-stock company regardless of nationality.

- Stock Corporation

This is a corporation with capital stock divided into shares and authorized to distribute to the holders of such share dividends or allotments of the surplus profits on the basis of the shares held.

- Non-stock Corporation

It is a corporation organized principally for public purposes such as charitable, educational, cultural or similar purposes and does not issue shares of stock to its members.

Some advantages of running a corporation:

· It can have a permanent existence;

· Management is efficient and centralized;

· Has the most effective means of raising capital and

· Has a separate juridical personality.

Some disadvantages:

· Complicated to maintain (capital requirements, paperwork, SEC approval);

· Subject to government intervention (compliance reports)

· Higher Tax and

· Activities is guided by its Articles of Incorporation.

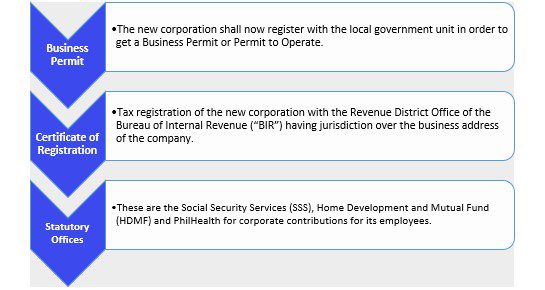

B. Post Incorporation Registrations

Corporations Organized under Foreign Laws

- Branch Office

A foreign corporation organized and existing under foreign laws that carries out the business activities of the head office and derives income from the host country. It is required to put up a minimum paid in capital of US$200,000.00, which can be reduced to US$100,000.00 if (a) activity involves advanced technology, or (b) company employs at least 50 direct employees. Registration with the SEC is mandatory.

2. Representative Office

A foreign corporation organized and existing under foreign laws. It does not derive income from the host country and is fully subsidized by its head office. It deals directly with clients of the parent company as it undertakes such activities as information dissemination, acts as a communication center and promote company products, as well as quality control of products for export. It is required to have a minimum inward remittance in the amount of US$30,000.00 to cover its operating expenses and must be registered with SEC.

- Regional Headquarters/Regional Operating Headquarters RHQs/ROHQs)

Under RA 8756, any multinational company may establish an RHQ or ROHQ as long as they are existing under laws other than the Philippines, with branches, affiliates and subsidiaries in the Asia Pacific Region and other foreign markets.

a. Regional Headquarters(“RHQs”)

An RHQ undertakes activities that shall be limited to acting as supervisory, communication and coordinating center for its subsidiaries, affiliates and branches in the Asia-Pacific region.

It acts as an administrative branch of a multinational company engaged in international trade.

It does not derive income from sources within the Philippines and does not participate in any manner in the management of any subsidiary or branch office it might have in the Philippines.

Required capital: US$50,000.00 annually to cover operating expenses.

b. Regional Operating Headquarters (“ROHQs”)

An ROHQ performs the following qualifying services to its affiliates, subsidiaries, and branches in the Philippines.

– General administration and planning

– Business planning and coordination

– Sourcing/procurement of raw materials components

– Corporate finance advisory services

– Marketing Control and sales promotion

– Training and personnel management

– Logistic services

– Research and development services and product development

– Technical support and communications

– Business development

Derives income in the Philippines

Required capital: US$200,000.00 one time remittance.