Have you ever came across the terms technology parks or hub, tourism economic zone, or even seen a signage that says Economic Zone? These are the special economic zones established in suitable and strategic locations to attract legitimate and productive investments, whether local or foreign.

The Philippine Economic Zone Authority (PEZA) promotes the establishment of economic zones in the Philippines for foreign investments. PEZA is also the Philippine government agency tasked to extend assistance, register, grant incentives to and facilitate the business operations of investors in export-oriented manufacturing and service facilities inside selected areas throughout the country proclaimed by the PEZA is the attached agency to the Department of Trade and Industry (DTI) tasked to promote investments, provide assistance, oversee and manage tax exemptions or other incentives to foreign investors or operators located in Special Economic Zones.

Business establishments operating within the ecozones are entitled to the fiscal incentives as provided for under Presidential Decree No. 66, the law creating the Export Processing Zone Authority (EPZA) that evolved to become PEZA, or those provided under the Omnibus Investments Code.

Classification of Economic Zones

- Special Economic Zone (SEZ) or ECOZONE – These are areas with highly developed or have the potential to be developed into agro-industrial, banking, recreational, commercial, export processing and financial centers.

- Industrial Estate (IE) – It refers to a tract of land subdivided and developed according to a comprehensive plan under a unified continuous management and with provisions for basic infrastructure and utilities, with or without pre-built standard factory buildings and community facilities for the use of the community of industries.

- Export Processing Zone (EPZ) – It is a specialized IE located physically or administratively outside customs territory but predominantly export oriented. Enterprises located in EPZ’s are allowed to import capital equipment and raw materials free from duties, taxes and other import restrictions.

- Free Trade Zone – It is an isolated policed area adjacent to a port of entry where imported goods may be unloaded for immediate transshipment or stored, repacked, sorted, mixed, or otherwise manipulated without being subject to import duties. But the movement of the imported goods to a non-free trade area shall be subject to import duties.

These Ecozones are operated within the framework of the constitution to the interest of national sovereignty and territorial integrity of the country. The Ecozone is developed into a decentralized and self-sustaining industrial, financial and investment hub with minimum government intervention. The Philippines currently has 415 economic zones across industries composed of the manufacturing economic zone, information technology park, tourism export enterprises, agro-industrial economic zones and medical tourism centers.

Foreign-owned companies may set up enterprises and enter into joint venture with Filipinos in any industry, international trade and commerce within the Ecozone. Their assets, profits and other interests will be protected provided that the minimum investment for any Ecozone enterprise has been met.

The majority of PEZA approved Economic Zones are spread across different regions all over the country, mostly in areas identified as a regional growth center. To name a few areas:

- Bonifacio Global City

- Baguio City

- Pampanga

- Laguna

- Batangas

- Cebu

- Davao

Benefits of PEZA-Registered Companies

PEZA offers both fiscal and non-fiscal incentives to enterprises operating within an Economic Zone.

- Income Tax Holiday (“ITH”), which provides 100% exemption from corporate income tax for four years in case of non-pioneer project, or six years for pioneer project, or three years for expansion project. The ITH may be extended for another year provided that no registered pioneer firm may avail of this incentive for a period exceeding eight years; five percent (5%) special tax on gross income in lieu of all national and local taxes upon expiry of the ITH;

- Tax and duty-free importation of raw materials, capital equipment and machineries to include spare parts;

- Zero -rating Value-Added Tax (VAT) of local purchases of goods and services (including land-based telecommunications, electrical power, water bills, and lease on the building, subject to compliance with BIR and PEZA requirements);

- exemption from payment of any and all local government imposts, fees, licenses or taxes, except real estate tax for the duration of the ITH;

- exemption from expanded withholding tax;

- Exemption from branch profit remittance tax for PEZA-registered branches of foreign companies;

- Permanent resident status of foreign investors and

- Extended visa facilitation assistance to foreign nationals and their spouse including dependents with multiple visa entry privileges.

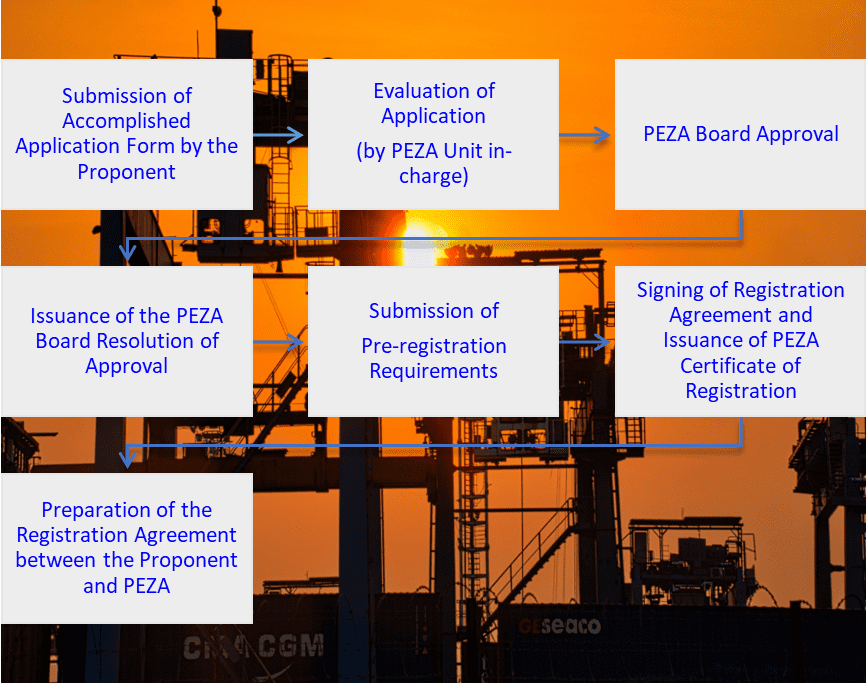

How to Register with PEZA?

In order to obtain the above privileges and incentives, one must apply for PEZA registration and base their operations in one of the PEZA zones, buildings, or technology parks.

Termination of Business

Investors who wish to terminate business or operations shall comply with the requirements set by the PEZA, particularly the clearing of debts. The assets of the closed enterprise can be then transferred or remitted subject to the guidelines set forth by the Bangko Sentral ng Pilipnas (BSP), Department of Finance (DOF) and the PEZA.